Choosing the right data centre for your company is a bit like searching for a property.

There is location. Is it a safe and well-connected area? Do you want the data centre to be in the cloud, on your business premises, or a hybrid of the two? And size. How many bedrooms and bathrooms? Loft conversion? Hot tub in the back garden? What computing capacity do you need? Can you add capacity as your business grows?

In the past decade, data centres have been getting bigger. Five years ago, companies were deploying 10 or 20 megawatts in a data centre. Now operators are talking about a campus with 100 or 200 megawatts.

Co-location and vast “hyperscale” data centres (often run by cloud computing suppliers such as Google, Amazon and Microsoft), are helping to meet growing consumer and business demand for computing resources – including a surge in work video calls, home-schooling software, or streamed television drama series during the pandemic of the past year.

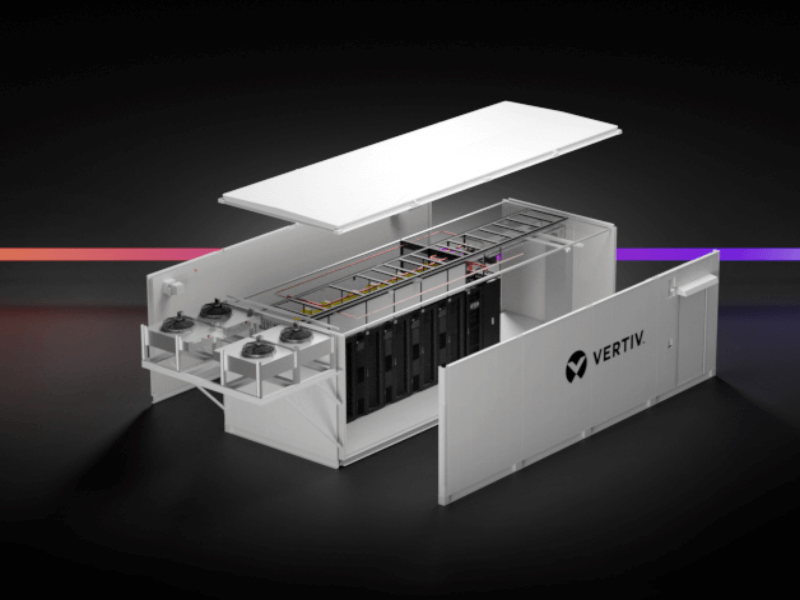

However, big isn’t necessarily better for many companies, and it is one reason why there is growing demand for mini data centres and prefabricated modular data centres − often in former shipping containers, or in purpose-built modules. Prefab data centres – including the rack cooling, air-conditioned cabinets and air-conditioned server racks that you would expect in a large data centre − can be built and deployed far faster than traditional data centres (within a few months rather than a year or more for a traditional data centre).

Modular Data Centre Infrastructure

By 2022, the global prefabricated modular data centre market will be worth $4.2 billion, up from $2.6 billion in 2017, according to 451 Research, a technology research company.

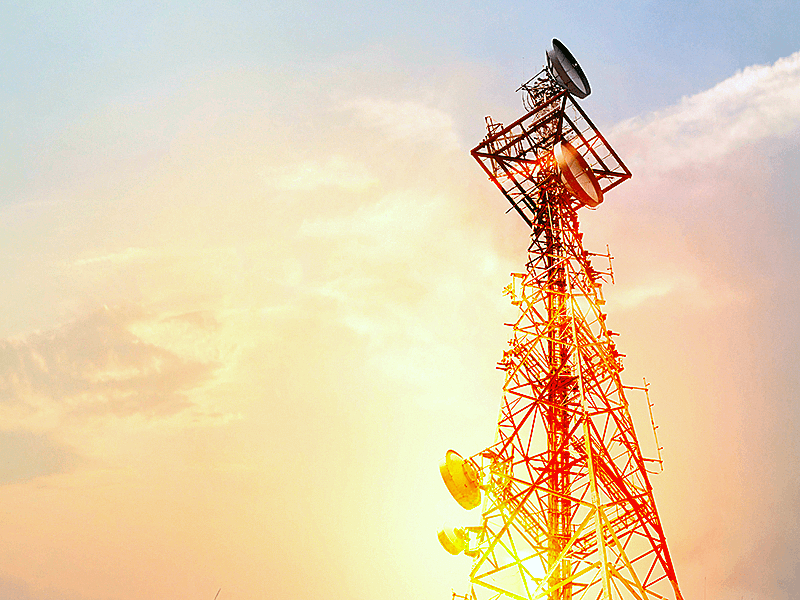

The market will also grow on the back of a growing market for “Edge” computing − where data is processed closer to the end user or device at the “Edge” of the network in places like 5G cell towers and small prefabricated data centres, or via hardware (such as gateway nodes) and increasing Internet-connected “Internet of Things” (IoT) devices.

By 2022, more than 50% of enterprise data will be created and processed outside the data centre or cloud, up from less than 10% in 2019, according to research company Gartner.

More computing power is expected to be run closer to people using it, at the Edge. If the Edge delivers on its promised benefits, in particular better network latency, it could see a major shift in how companies spend their IT budgets. Forrester, another research company, has said that Edge computing growth may divert some IT budgets away from the cloud, shaving five points off public cloud growth.

The Micro Data Centre Market

In between hyperscale/co-location data centres and prefabricated data centres, a new type of “micro” data centre is emerging. Definitions vary, but a “micro” data centre is typically a factory-built air-conditioned cabinet with a protective shell, a single or double air-conditioned server rack inside, and its own Uninterruptible Power Supply (UPS) and Power Distribution Unit (PDU).

The market is nascent but growing. By 2025, the global market for “micro mobile data centres” will be worth $6.5 billion, up from $3 billion in 2020, according to a forecast by MarketsandMarkets.

Data centres are facing increased regulatory scrutiny around the world, whether it’s tougher data protection laws, such as Europe’s General Data Protection Rule (GDPR), which came into effect in 2018, IT security, or new rules on the size of data centres, amid a scarcity of land for urban property development.

By being closer to the user and on (or near) it’s premises, micro data centres can also help organisations comply with IT security regulations − especially for their most commercially sensitive, which they may not want to put online, in the cloud.

Micro data centres are also ideal for use with Edge computing networks, such as retail stores, transportation, healthcare and light industrial applications. They can also help our digital infrastructure meet an increasing demand for computing power.

As Rahiel Nasir, research analyst, specialising in data centre services and infrastructure at 451 Research, S&P Global Market Intelligence, said during a recent Vertiv event on modular data centres, that a “massive” number of Edge locations will be needed to support the growing demand for cloud computing services and other technologies such as the IoT.

By 2025, more than 100 billion “device Edges”, for example, in sensors, cameras and drones, will be needed, plus more than 100 million “enterprise Edge” locations (including in “micro” data centres), he added.

Data Centre Market Evolution

Edge networks may be relatively new, but the micro and modular IT kit have been around for quite a while. As 451 Research has noted, telecommunication companies have been using street cabinets for decades to install “last-mile” network equipment outdoors.

Edge networks fit a sweet spot in the data centre market for most companies that keep much or all their data centre equipment on site.

Not all companies will want a prefabricated modular data centre outside or near their building. Ruggedised versions of micro data centres can live outside offices, but they are typically better suited to office server rooms and server closets.

With their modular racks and server cabinet cooling, micro data centres, of course, don’t need much space and enable companies to retrofit their data centre to accommodate Edge computing.

Vertiv – a leading supplier in the modular data centre market − is keen to help the micro data centre market achieve its potential.

In May, Vertiv released a new version of its micro data centre: Vertiv™ VRC-S, a factory-assembled micro data centre designed for fast, easy installation at the Edge of the network and other small IT sites.

The Vertiv VRC-S, available now in Europe, Middle East and Africa (EMEA), includes a rack PDU, UPS, monitoring sensors and software, and the latest rack cooling system in a highly-efficient, all-in-one IT rack. It can be delivered in days and installed within hours.

Unlike prefabricated modular data centres, which are typically larger stand-alone installations deployed outside main buildings or in remote locations, micro data centres can be used in environments including offices, clinics, retail stores, or other commercial or industrial spaces.

As micro data centres go mainstream, they are likely to help power the next wave of high-performance computing including artificial intelligence, analytics, and 5G. For an increasing number of businesses, these small but powerful and versatile data centres, are likely to be the ideal home for their growing data infrastructure.