It was exciting last week to join an all-star panel at Data Center Dynamics Europe 2020: ‘The rise of Europe’s emerging markets’. It was a great opportunity not only to reflect on how Edge, hyperscale, 5G and data sovereignty are driving more demand for data center capacity across Europe, but also to discuss how the data centre industry is responding to the COVID-19 pandemic and its ongoing socio-economic impact.

The session highlighted how drastically the European data center market has shifted recently. Gone are the days when development solely happened in the ‘FLAP’: Frankfurt, London, Amsterdam and Paris. Indeed, this was reflected in the panel, which brought together expertise from the Italian, Spanish and Polish markets. Thanks to Sherif Rizkalla, Chairman & CEO, SUPERNAP Italia; Juan Vaamonde, Group Operations Director and Spain Country Manager, Data4; and Daniel Szcześniewski, CEO, Atman for helping make the session such an enjoyable and insightful experience!

Europe’s FLAP Data Center Markets Have Formidable Rivals

We kicked off the session by challenging the very term ‘tier-two’. Yes, the more mature FLAP markets still hold sway in terms of their capacity, but ‘tier-two’ is not an accurate description of the opportunity that so clearly exists outside of these regions.

During the panel we heard, for example, about the rapid maturation of the Spanish data center market. With its population of more than 45 million and a market with more than 80% internet penetration, latency has improved by more than 30% in some areas of Spain.

We also heard that data center capacity has doubled in Milan in the course of a single year and that Dublin has 500 megawatts of construction underway. Moscow, too, has seen rapid growth with the expansion of cloud services having an impact on the entire territory, while Russia more broadly has seen a dual demand for both capacity and speedy deployment.

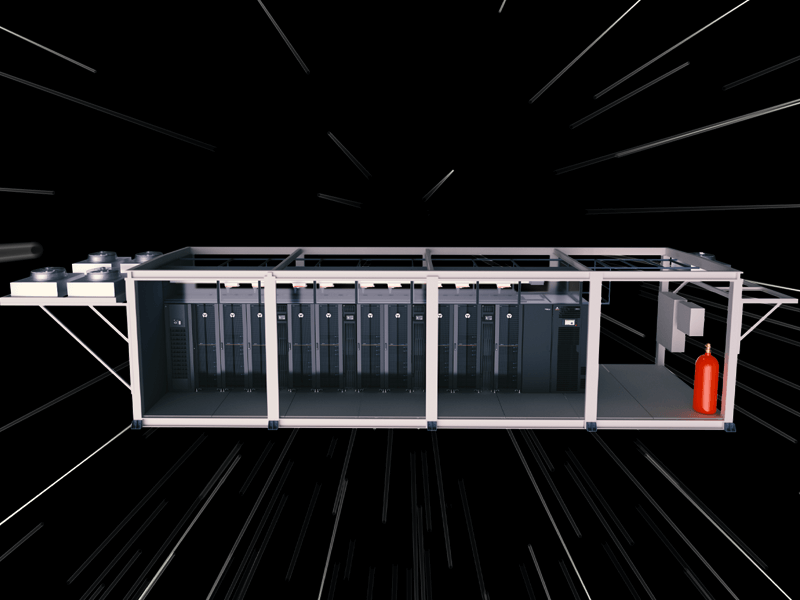

The picture is similar elsewhere in Europe and this has led to something of an arms race in the cloud, which has necessitated a growth in prefabricated and modular data centers as solution-focussed, rapid deployment and plug-and-play alternatives to traditional build.

While the focus of the event was on Europe, my experience in the EMEA region hopefully helped contextualise the broader picture. In Africa, for example, where the level of growth is not as fast as previously expected, we are beginning to see key areas that are catching up with Europe.

There were some other interesting trends cited, too. Regardless of data sovereignty regulations, for example, customers are preferring to keep their data close: ideally in the same country where they operate – if not the very same city.

Scaling with confidence is something we pride ourselves on at Vertiv. For more on our work in this space, please visit our dedicated page here.

Edging Towards Definition

On the panel, I also had the unenviable task of defining the Edge. Here, the analogy of an accordion came to mind, with people shrinking or stretching the Edge definition depending on need. In reality, the Edge is an integral part of the cloud, somewhere where tens of megawatts of data center capacity lie.

In third and fourth tiers Edge will continue to expand over the coming years – especially in the context of 5G and IoT, Edge applications and Edge data centers in densely populated areas. Wherever there is high density of data processing, there will be a demand for the Edge.

In emerging markets there is something of a lag – of two, three, five years even – and, looking into my crystal ball, I think we’ll see more focus on energy efficiency in data centers. For example, during the panel we heard how in Spain, more than half the energy output is from renewables, like wind and solar, and the geography means that it is a ‘safe’ market, largely free from the risk of natural disasters. Certainly, the Edge data center can’t be viewed in isolation from the grid, and in future we’ll see more and more remote management.

The Future is Bright

Amidst the lively discussion, what came through loud and clear was the scale of growth and potential across the region and worldwide. The rapid shift to remote working and boom in streaming services has put further demand on data centers, with new capacity being deployed and hyperscale will continue next year and beyond.

With over 1,600 data center companies in the world, the future for our industry is very exciting. Working with companies like those represented at our panel at DCD Europe and supporting as they scale their operations, either to new markets or enlarging their local presence, is rewarding at this time of accelerated growth.

For more industry expert insight into the colocation market, take a look at Vertiv’s new ‘Colocation Data Center Market Prospectus’. Alternatively, for more on how Vertiv partners with colocation providers who need to scale quickly and resiliently, check out some of our recent case studies.